409 A Valuation Vs VC Valuation: Know The Difference

Wondering about the 409A valuation vs. VC valuation? What is the meaning of post-money valuation? Learn more about these important valuation methods here.

Employee Stock Ownership Plans (ESOPs) is an integral part of many startups, offering employees a stake in the company's success. However, to accurately determine the value of these stock options, startups must undergo a 409A valuation. While it may not be the most exciting task on a founder's to-do list, understanding and fulfilling this requirement is essential to ensure both compliance and fairness.

A 409A valuation is a structured assessment of the fair market value (FMV) of a private company's common stock. Its purpose is to establish the lowest exercise price for stock options and is usually conducted by an impartial third-party valuation firm. Adhering to this method is essential for tax compliance when issuing options to employees based in the US.

The need for 409A valuations arose from concerns about the undervaluation of stock options granted to employees by private companies. These concerns were amplified by the Enron scandal. This exposed the potential for abuse when companies undervalued their stock, allowing executives to reap significant tax benefits through lower exercise prices on their options.

In response, the US government enacted the IRC Section 409A in 2004. This section established clear guidelines and regulations for valuing stock options granted to employees by private companies. It emphasized the importance of determining the fair market value (FMV) of the company's stock through a qualified and independent 409A valuation, which would serve as the basis for setting the strike price of employee stock options.

While both 409A and post-money valuations deal with a company's value, they serve distinct purposes and utilize different approaches. Understanding these differences is crucial for startups navigating the fundraising and employee equity landscape.

409A Valuation: Determines the fair market value (FMV) of a company's common stock specifically for setting the strike price of employee stock options. This price reflects the current market value independent of future funding or growth expectations.

Post-Money Valuation: Estimates the company's value after a funding round has been completed. This valuation takes into account the investment amount and the percentage of ownership acquired by the investor. It reflects the future potential and growth expectations factored in by the investors.

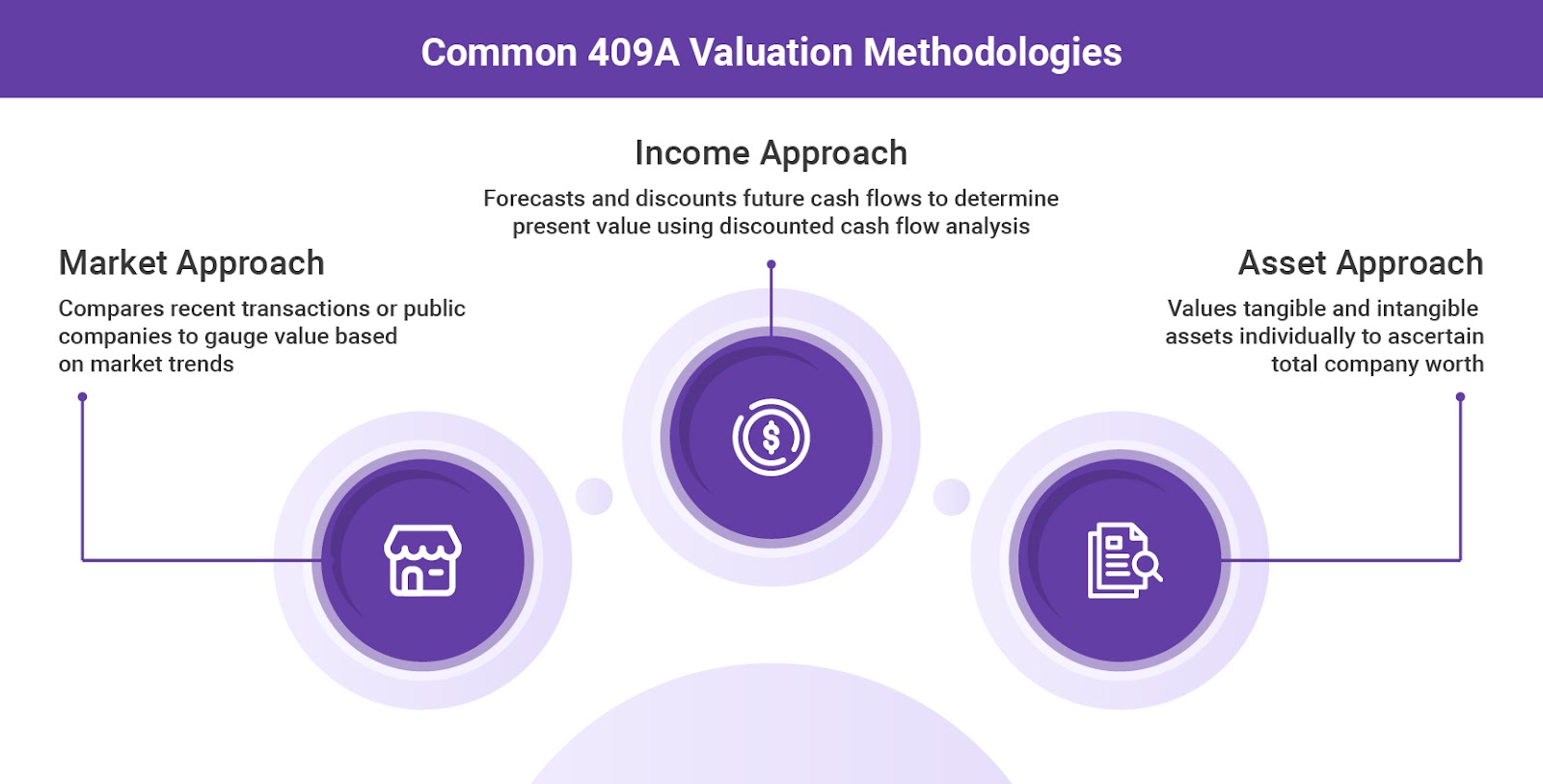

409A Valuation: Employs various methodologies and valuation frameworks, like the Market Approach, Income Approach, and Asset Approach, focusing on data and comparable transactions to arrive at a conservative estimate of the FMV.

Post-Money Valuation: Often relies on a simpler calculation based on the investment amount and ownership percentage ceded to the investor. It doesn't go through the intricate details of financial projections or comparable transactions.

409A Valuation: Primarily concerned with establishing a fair and accurate price for employee stock options, ensuring transparency and compliance with IRS regulations.

Post-Money Valuation: This is mainly used for negotiation purposes during funding rounds, reflecting the perceived future value of the company and the investor's stake.

409A Valuation: The direct outcome of a 409A valuation is the strike price for employee stock options, which should be set at or above the FMV determined through this process.

Post-Money Valuation: Doesn't directly influence the strike price of employee stock options, as it focuses on the company's equity value after a funding round.

In essence, 409A valuations objectively assess a company's current market value for employee stock options, while post-money valuations are more subjective estimates used during fundraising negotiations.

409A valuations are more than just another legal hurdle; they're a critical tool for ensuring your company operates with compliance, fairness, and employee protection in mind.

Failing to obtain a qualified 409A valuation before issuing stock options can trigger significant tax penalties for both the company and its employees. The IRS imposes these penalties in situations where the options are deemed to have been undervalued. A proper 409A valuation acts as a shield against potential legal challenges from the IRS regarding the accuracy of the option pricing. This provides peace of mind and avoids costly disputes.

Establishing a fair market value for employee stock options through a 409A valuation fosters trust and transparency within your organization. Employees can be confident that the options they receive are accurately priced and reflect the company's true value.

This transparency promotes a culture of ownership and accountability, as employees become more invested in the company's success when they understand the value proposition of their stock options.

An accurate 409A valuation safeguards your employees from unexpected tax liabilities down the line. When employees exercise their stock options, they are subject to capital gains taxes. An accurate valuation ensures the strike price accurately reflects the stock's value, minimizing the potential for unexpected tax issues for employees. By fulfilling the requirement for a 409A valuation, you demonstrate responsible corporate governance and commitment to ethical business practices.

Now that we've established the importance of 409A valuation, let's look at one of its most valuable aspects: the safe harbor provision.

When you obtain a qualified 409A valuation from an independent third-party appraiser who meets specific IRS requirements, you gain access to the safe harbor provision. This means that the IRS presumes the valuation to be fair and reasonable unless they can demonstrate clear evidence that it was grossly unreasonable at the time it was conducted.

So, how does it work?

When a company adheres to the following guidelines, they are considered to be operating within the safe harbor of Section 409A:

By fulfilling these requirements and staying within the safe harbor provisions, companies gain several key benefits:

Reduced risk of IRS challenges: If the valuation meets the safe harbor criteria, the IRS is less likely to challenge it. This provides peace of mind and minimizes the potential for costly disputes.

Enhanced legal protection: In the event of an IRS challenge, the safe harbor provision offers a strong legal defense against penalties or tax implications arising from an inaccurate valuation.

Increased investor confidence: Demonstrating compliance with safe harbor standards can boost investor confidence in the company's governance and financial practices.

Remember, safe harbor doesn't guarantee complete immunity from IRS scrutiny. However, it significantly reduces the risk of challenges and provides a strong legal foundation for your 409A valuation.

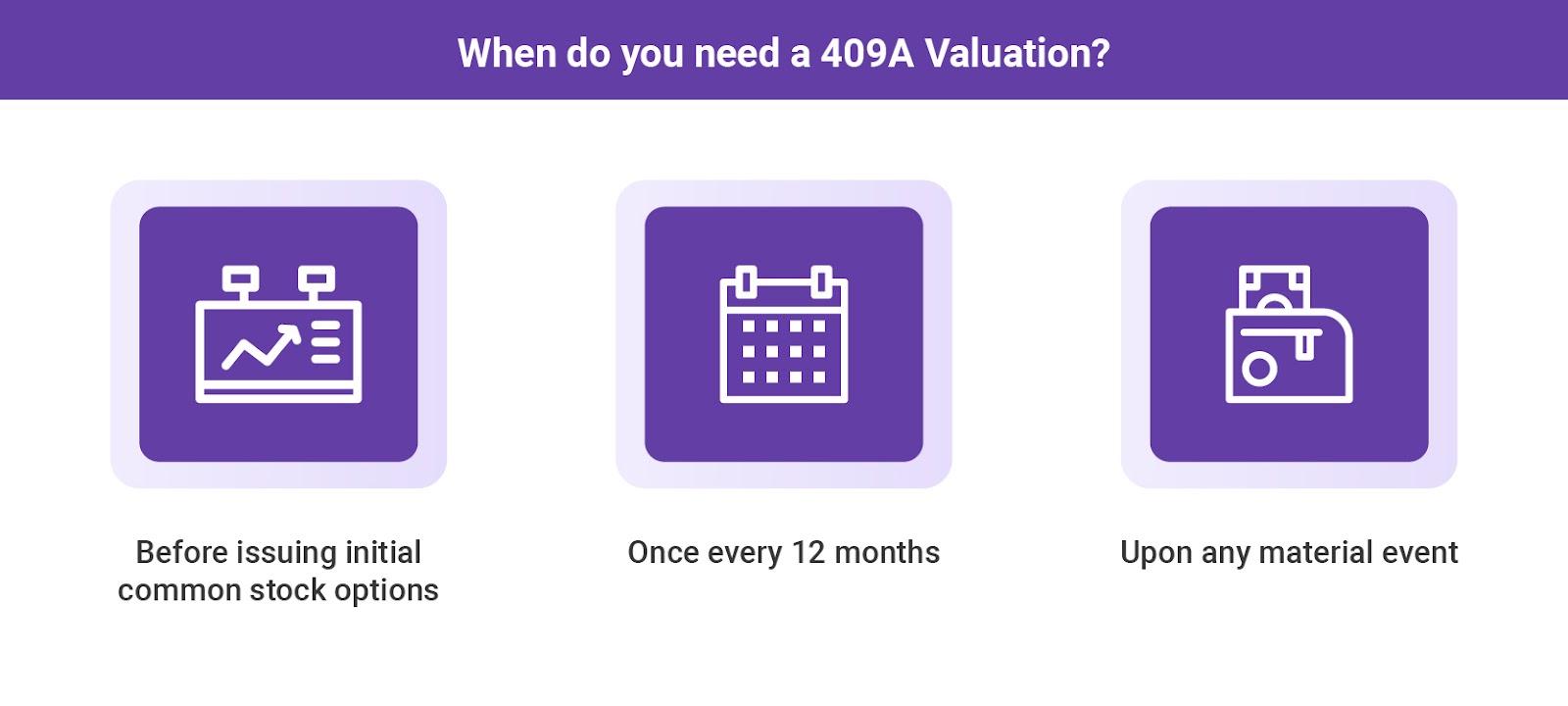

A 409A valuation is first required before granting any employee stock option grants, establishing a fair and transparent foundation for aligning employee incentives with the company's actual market value. While these valuations typically remain valid for 12 months, regular updates are crucial, especially for subsequent option grants.

Even beyond mandatory situations, it is a best practice to conduct 409A valuations every tax year to maintain compliance and ensure continued accuracy. This proactive approach allows companies to stay ahead of market changes and maintain transparency with employees.

Additionally, significant material events like major funding rounds, mergers, and acquisitions, liquidity events, or substantial shifts in the company's business can trigger the need for a new valuation, even if the previous one is still technically valid.

So, you're considering getting a 409A valuation done for your startup, but you're not quite sure what the process entails? Here’s a quick step-by-step guide to your first 409A valuation.

Step 1: Engage an Independent Third-Party Appraiser

First things first, you'll need to choose the right third-party 409A valuation provider. This is crucial for ensuring an unbiased and accurate valuation. Look for an appraiser with experience in your industry who understands the nuances of startup valuations. It's also important to ensure that the appraiser can do an independent appraisal and is free from any conflicts of interest.

Step 2: Provide Relevant Financial Information

Once you've selected an appraiser, you'll need to provide them with all the necessary financial information about your company. This includes recent balance sheets, income statements, cash flow statements, and any other relevant financial documents. Transparency is key here, so make sure to provide all the information requested in a timely manner.

Step 3: Utilize Different Valuation Methodologies

The appraiser will then utilize various valuation methodologies to determine the fair market value of your company's common shares. These methodologies may include the Market Approach, Income Approach, and Asset Approach. Each methodology has its own strengths and weaknesses, so the appraiser may use a combination of them to arrive at a more accurate valuation. We cover these in detail below.

Step 4: Receive a Valuation Report

Once the appraiser has completed their analysis, they will provide you with a valuation report detailing their findings. This report will include the estimated fair market value of your company's common stock, as well as any assumptions and methodologies used in the valuation process. Take the time to carefully review the report and ask any questions you may have.

Valuation firms like Qapita empower you to customize reporting and automate disclosures for employees, grants, and vesting at any level (individual, group, department) while streamlining compliance.

<We can add a screenshot of Qapita’s 409A Valuation Report here, or we can have a sample report created for users to download. This can be gated and used as a lead magnet >

Step 5: Address Concerns

If you have any concerns or questions about the valuation, don't hesitate to discuss them with the appraiser. It's important to address any issues upfront to ensure that the valuation accurately reflects the value of your company.

Now that you know how a 409A valuation works, let’s look at the common 409A valuation methods.

When it comes to conducting a 409A valuation for your startup, understanding the different methodologies used is key to obtaining an accurate assessment of your company's worth.

The market approach compares your company to similar companies that have recently been acquired or become public companies. The appraiser will analyze the transaction data of these comparable companies to estimate the fair market value of your company.

This method is most applicable when there are a sufficient number of comparable companies in your industry and at a similar stage of development.

The income approach uses a company's projected future cash flows to estimate its current value. The appraiser will forecast the company's future revenue and expenses and then discount these cash flows to their present value using a discount rate that reflects the risk of the company.

This method is mostly used for companies with a predictable and established revenue stream.

The asset approach values a company based on the FMV of its identifiable individual assets, both tangible and intangible. This includes property, plant and equipment, inventory, intellectual property, and brand value. The appraiser will sum the fair market value of each individual asset to arrive at a total value for the company.

This method is used for companies with significant tangible assets or valuable intellectual property.

As we mentioned earlier, each methodology has its own strengths and weaknesses, so the appraiser may use a combination of them to arrive at a more accurate valuation.

Pssst! We also cover some of the most commonly used models in option valuation in our other blog post.

To prepare for a 409A valuation, you'll need to do due diligence and gather and present several key documents and information to the appraiser. Here's a quick glance:

Additional Information:

Remember, the appraiser relies on the information provided to conduct a thorough and accurate valuation. Completeness, accuracy, and transparency are essential for a successful 409A valuation.

To make it easier for you to gather all preliminary information, we’ve created a checklist you can use right away.

The cost of a 409A valuation varies depending on your company's size and complexity. Standalone valuations usually range from $1,000 to over $10,000, with larger and more complex companies incurring higher fees. Some providers offer bundled services that may include the valuation alongside other startup essentials, potentially impacting the overall cost.

At Qapita, we understand the importance of navigating the 409A valuation process efficiently and cost-effectively. Our ‘Basic Plan’ offers essential equity management tools, including cap table management and ESOP management, for free at the pre-seed and seed stages. This allows you to focus on your company's core growth initiatives while ensuring compliance with essential requirements like 409A valuations for future funding rounds.

Skipping a 409A valuation might seem like a shortcut, but it can lead to significant downsides for both your company and employees:

Tax Penalties: The IRS imposes hefty tax penalties on both the company and employees if stock options are deemed undervalued. This can significantly impact your finances and employee morale.

Talent Acquisition and Retention: Uncertainty about stock value due to a missing 409A can make it difficult to attract and retain top talent. Competitive compensation packages often include stock options, so their absence can put you at a disadvantage.

Reputational Damage and Legal Disputes: Failing to comply with regulations can damage your company's reputation. Additionally, the lack of a 409A opens the door to potential legal challenges, resulting in costly litigation and further reputational harm.

At Qapita, we understand the challenges startups face in managing their equity effectively. That's why we offer a tailored suite of valuation reports meticulously designed to meet your specific needs. With a keen eye on compliance, we adhere to diverse accounting standards such as IGAAP, IFRS, and SFRS, ensuring accuracy and reliability every step of the way.

With Qapita's comprehensive equity management tools at your disposal, you can focus on your core business activities, knowing that your equity is managed efficiently and compliantly.

Start your 409A valuation journey today. Talk to the experts at Qapita.