-min.png)

If you participate in an Employee Share Scheme (ESS) in Australia, your employer has an obligation to issue you with an annual tax statement called ESS statement by 14 July. As this deadline has now passed, let’s explore what plans are considered ESS, what information ESS statements contain, how they impact your tax return, and why did you receive one, and why in some cases ESS statements are not required to be issued to you.

You are encouraged to learn more about ESS reporting requirements, using plenty of great materials available online, and especially utilising the detailed information and examples provided by the ATO on their website.

This article is general in nature and has been prepared for informational purposes only. The article is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your tax, legal and accounting adviser to discuss your specific circumstances and before engaging in any ESOP transactions or completing your income tax return.

So, what does ESS reporting involve?

Your employer must provide you with a statement by 14 July for the tax year up to 30 June, and report the underlying data to the ATO, so it can be used to pre-fill your income tax return. This reporting is required for employee share schemes. ESS is defined in Division 83A of the Income Tax Assessment Act 19971 as a scheme under which ESS interests in a company are provided to employees, or associates of employees in relation to the employee's employment. If you participate in an ESOP in Australia, more likely than not it’s classified as ESS – if you revisit an earlier article, you can find out how to check this.

When will an ESS statement be issued to you?

Even if you are a current equity plan participant, you may not necessarily need to be issued an ESS statement. The requirement for your employer to prepare one is generally triggered in the scenarios when:

There can be various triggers for the deferred taxing point. It can occur on vesting, exercise, sale, and even cessation of employment depending on your equity plan design. Note that after 30 June 2022, cessation will stop being a taxing point trigger.

It’s always helpful to learn an understand what triggered the taxing point and how it got calculated. The good news is that you don’t need to become an ESS taxation expert – your employer would’ve done the hard part of figuring all the rules out, and the statement represents the final outcome of reportable values based on all the relevant tax rules and your individual circumstances. This guide is merely a high-level introduction to the topic and will not explore all the possible scenarios of how deferred taxing point arise for various types of plans.

What if you didn’t receive an ESS statement?

Naturally, you might think it’s when none of the above three triggers occurred. And you would be right – but only partially. There could a couple other explanations:

Not all ESOPs are classified as ESS. One notable example is loan share plans. Loan funded schemes are not classified as ESS for tax purposes, and as a result do not trigger ESS reporting requirement. Instead, you will need to consider capital gain tax implications for your loan share plan transactions.

And mistakes do happen. Your employer may have overlooked and missed your reportable transactions. Or your employer may not have been aware of the ESS reporting requirement and has missed the reporting deadline all together. This unfortunately does happen, especially for young statups trying to get their head around all the compliance requirements, and foreign companies with Australian based employees.

If after reading this guide, and seeking the appropriate advice, you feel like you should’ve been issued a statement, but haven’t received one, reach out to your employer and ask them about it (HR, Reward or Finance functions are generally responsible for this).

Data reported on an ESS statement will need to be used by you to prepare your tax return for the previous year and/or in future years (and in some circumstances, earlier years – see Amended Statements section below). Let’s go through the ESS statement to understand what can be presented on it and how the information should be used.

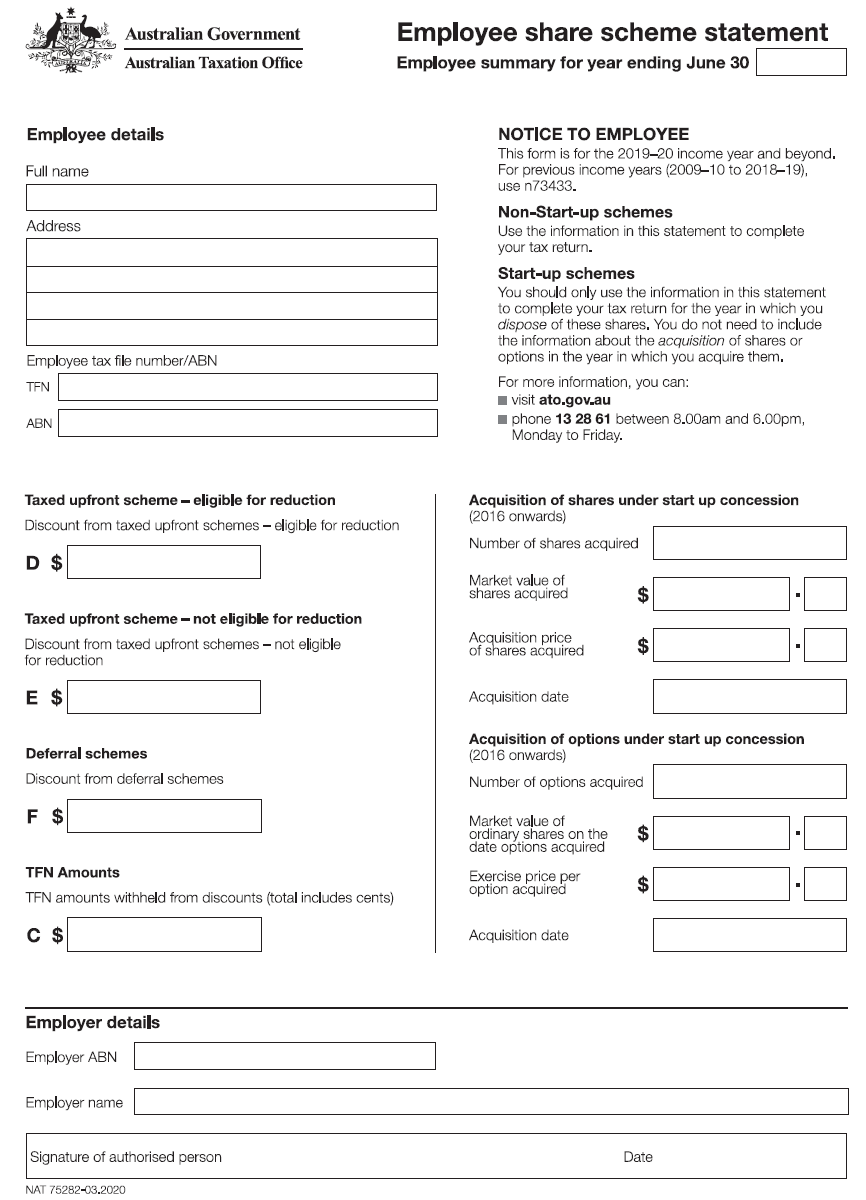

Above you can see a sample ESS statement in the standard ATO format (source: ATO website). Your statement may look a bit different if your employer utilised a third party to help prepare it, but it will contain the same required data fields. The data is split into two sections:

1. Non-start-up concession schemes

Values reported here need to be included in the relevant label in Item 12 of your income tax return for the year of the statement. The relevant label you may find are:

12D – Discount from taxed upfront schemes – eligible for reduction

12E - Discount from taxed upfront schemes – not eligible for reduction

12F – Discount from deferral schemes

12C – TFN amounts withheld from discounts

These labels are a bit confusing - what do they actually mean? Amounts reported in 12D (up to a maximum of $1,000) is the amount of income that you won’t need to pay tax on if your income for the year is no more than $180,000. If you don’t pass the test (i.e. your income is over 180k), you will need to declare the amount shown in 12D and that will form part of your assessable income for the year.

Data in 12D is often derived from your participation in tax-exempt share plans (common for large listed companies when you are either gifted or you purchase up to $1,000 worth of shares).

The amounts in 12E, 12F and any amount in excess of $1,000 in 12D is something that will form part of your total assessable income for the year. These are the numbers that you and your tax accountant will be most interested in.

12C will show any withheld amounts for the year due to your employer not having your TFN, which generally shouldn’t occur.

2. Start-up concession schemes

Data reported here will need to be used in the year when you dispose of the shares by selling or transferring them.

The information presented covers:

Why are ESOPs granted under start-up concessions treated differently and are not reportable? That’s the beauty of these types of plans for employers that meet certain eligibility criteria. If you received a grant under a start-up concession scheme, you do no need to report the values in relation to the acquisition of shares or options in the year they were allocated to you. Instead, you will need to report a capital gain or loss when you sell or transfer the shares in future.

Ok, so do you need to work out all this on your own and make sure you plug it all in accurately into the relevant fields of your tax return? Maybe, but you shouldn’t be required to. Your employer in addition to issuing you the statement by 14 July must also lodge that same information with the ATO by 14 August. That means once the ATO receives the data and processes it, the information should be pre-filled in your tax return.

If you eager to submit your tax return as soon as possible, keep in mind that your data may not be pre-filled just yet. In any case, always be sure to cross reference your tax return information with the data in your ESS statement.

If you are like me and tend to employ the ‘trust but verify’ approach and attempt to calculate your own ESS tax liability and compare it to the data in the statement, you may come across minor reconciliation differences. If you are off by a dollar or two, this will likely be due to the fact that ESS data only capture whole dollar amounts and ignores cents. You can think of your ESS obligation that is shown on the statement and reported to the ATO as being ‘rounded down’ for each reportable transaction. If you had multiple exercises, and as a result multiple taxing points, each one of them will be impacted by this ‘rounding’. If you calculated your deferred taxing points amounts to be $650.94 and $511.85 respectively, only $1,161 will be reported in total, not $1,162.79. So you might need to pay a tiny bit less tax than you might have expected. Count it as a win.

As always, things are not always straightforward. Here are some of the things to keep in mind:

Generally, the statement issued to you assumes you are an Australian resident for tax purposes, and the data presented should be reported accordingly. However, with increase international mobility, this may not be true for your specific circumstances. You will need to seek guidance and advice on how you may be impacted by Australian’s double tax agreements and the rules around temporary tax residence.

Your employer may ignore any foreign employment and report gross ESS amounts to the ATO or consider it and report your actual assessable amounts (e.g. only 50% of the value if you spent only half the time of the life of the ESOPs from grant to taxing point working in Australia). You will need to carefully review this information to ensure you meet any of your reporting obligations in Australia and/or overseas.

Your mobility can be the exact reason why you may have not received a statement. If your employer has determined that 0% of your reportable ESOPs value is in relation to your employment in Australia, you wouldn’t receive a statement at all (instead of receiving a statement with a bunch of zeros on it).

Your original tax statement may be replaced by an amended one later on. Why might that happen? Perhaps, your employer made a mistake that they need to correct. Or they became aware of new information that means that information reported earlier is no longer accurate. For example, the award that was reported earlier may have been forfeited later – perhaps because the performance conditions attached to the grant were not met. Your employer would then go ahead and adjust your reportable data to reflect this. And that makes practical sense – if you didn’t end up receiving the benefit, why would you need to pay tax on it?

You employer is required to issue you with an amended ESS statement within 30 days of finding out of the relevant changes that trigger the need to amend your reportable values.

Whilst the above is true, the amendment won’t be triggered if you had vested options, had opportunity to exercise them, chose not to do so and they expired. If there was an earlier reportable taxing point – it won’t get amended. If you are in this situation, you would want seek advice on appropriate treatment.

So far, we have introduced various triggers of income tax – and that is what ESS statement is designed to help you report. However, as you might be aware, shares may also be subject to capital gains tax. The same lot of ESOPs may be subject to income tax only, capital gains tax only, or both. And don’t forget any considering any tax liabilities as a result of dividends and distributions that you may receive on the shares that you hold.

One important rule to be aware of is the 30-day rule in relation to deferred taxing points. If a deferred taxing point was triggered for you (e.g. as a result of exercise of options), and you disposed of your resulting shares within 30 days after that, the deferred taxing point will be changed to the date of the disposal (i.e. date sale or transfer). As such, instead having an income tax trigger first and the resulting capital gain or loss a couple of days and weeks later, only a single event is reported for income tax purposes, and no capital gains are considered. However, if the disposal occurred outside of the 30 day window, you will need to consider implications for both the original taxing point, and the later capital gains tax or loss that eventuated.

You ESOP rules may allow you to hold your ESS interests in the name of your associate, which could be a company or a trustee of a trust. Important thing to note is that ESS reporting rule will still apply to you, the employee, and the relevant reported values will be captured in your own return. It’s important to seek professional advice for scenarios like this.

You may work for employer whose share price is quoted in a currency other than AUD. For that reason, FX conversion would have taken place to come up with your final reportable values in AUD. This can make the calculations a bit trickier to reconcile. Be sure to ask your employer to provide any clarification needed on the calculations and FX logic utilised.

The timing of deferred taxing point may be impacted by additional selling restrictions and blackout periods that may have been applied to you by your employer. Consult your employer to understand if that was the case and seek advice on what adjustment may need to made as your prepare your income tax return.

Despite their best efforts, your employer may not have all the information required to report accurately. For instance, they may not be aware of transactions that you facilitated after vested (e.g. sale or transfer of shares) to consider the 30-day rule, or the don’t have a full picture of your location history to accurately apportion your ESS values for the period of time associated with employment in Australia, so will opt to report the gross amounts and let you work out the actual figures that should be reported. It is always best to double check the reported data, consider your own circumstances, and seek professional assistance from tax advisers to ensure that your reporting obligations are met.

ESS tax reporting is tricky. You may get a statement when you haven’t sold your shares. You may also not need a statement when you had transactions that took place. You may have values you need to report for the relevant year, or values that you won’t need until a couple of years down the track.

Hopefully this guide provided a bit more clarity for you of what your ESS statements means and how to understand what information int contains. Even though we haven’t covered all possible scenarios, the hope is that you are a bit more comfortable talking to your employer or tax accountant about your tax obligations.